2024 Notice of Annual Meeting and Proxy Statement

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. |

2024 Notice of Annual Meeting and Proxy Statement

MISSION Our mission is to provide quality, compassionate care in the communities we serve. Creating an ethos of good health, wellness and responsibility is central to our mission and an everyday commitment to our neighbors and families. VISION Our Vision is to consistently deliver the right care, in the right place, at the right time and to be a premier organization, where patient care and saving lives remain our focus. Our vision re ects our aspirations for the future and the goals we work toward – together. We are better together.

|

|

|

Dear Fellow Shareholders,

In 2022,2023, Tenet delivered a solidcontinued to deliver strong financial performance continuing to demonstrateand disciplined management and strong operational execution to drivebuild long-term value for our shareholders. Our team effectively navigatedThe year was a dynamic operating environment with further COVID related disruptionstestament to our team’s resilience and inflationary pressures. Our consistent operating performance and deleveraging over the last several years has increased our ability to generate stronger free cash flow. Underpinning this is a steadfast commitment to excellence in compliance, and quality, and safety, as we continually enhanceenhanced healthcare services in the communities we serve. Our commitment to partnership with physicians to build new and cutting edge healthcare services is a distinctive feature of our communities.business model.

We finished 2022 strong with fourthEach quarter results consistent or abovein 2023, Tenet exceeded the performance expectations we set for all three business segments.set. This was driven by increased volumesa result of continued demand for our care and excellent cost management. We also delivered strongour ability to effectively manage resources in the right place at the right time such that we could optimize the performance across our operations. This resulted in improvement in cash flow generation during the year which helped us find opportunities to invest in 2022, congruent with the increasing value of the key parts of our business. Most importantly, we remained focusedcommunities and reduce leverage on the transformationbalance sheet.

Tenet maintained its positive momentum this past year, marking it as one of Tenet into a high-performing, diversified healthcare services company. exceptional performance and continued strategic transformation. Let me share highlights.

Accelerating Tenet’s portfolio transformation. We continued to expand our industry-leadingtransform towards a more value-based care enterprise with a leading specialty care platform. In 2023, we announced the divestiture of three Coastal South Carolina hospitals and related entities, continued to develop a new hospital campus in San Antonio, Texas and added thirty lower-cost ambulatory surgery business and increased our higher acuity, specialty care services.

Tenet is well-positionedcenters to continue executing our strategic focus that was set into action several years ago as part of a transformative strategy. Let me provide some highlights.

USPI remains a distinctive, industry-leading ambulatory surgery platform that we continue to scale. In 2022, USPI maintained its track-record for delivering 4 to 6% annual, same-facility revenue growth, a testament to higher acuity growth. For example, total joint cases grew by over 13% in 2022 relative to 2021.USPI. USPI’s M&A engine, under the Tenet umbrella, continues to be an industry-leading differentiator with 45 centers addedand we maintain a robust pipeline. We continue to the portfolio in 2022. We intend to invest approximately $250 million in ambulatory M&A andexecute strategic acquisitions, de novo center development each year,developments and we havedivestitures to advance our business transformation, reduce leverage and enhance free cash flow over time.

Meeting community demand for high-quality care and access to care. We delivered exceptional growth in 2023. USPI had 9.2% growth in same-facility revenues, well above our long-term goal of 4-6% growth. USPI also increased higher acuity procedures with joint replacements up nearly 20% in the fourth quarter. The hospitals enhanced access to high-acuity care across cardiovascular, neurosciences, surgical services and more. This resulted in sustained acuity growth with fourth quarter 2023 revenue per adjusted admissions up 6.5% over the prior year. Conifer also announced new clients and renewals, including the continuation of an end-to-end revenue cycle management partnership with Dartmouth Health.

Delivering the right resources at the right time, supported by data-driven decisions. Each of our business segments enhanced operational efficiency in 2023. Our operations delivered industry-leading margins in our ambulatory segment and made a robust pipelinestrong commitment to support that level of investment.

The hospital portfolio demonstrates consistency in performance and continues to transform. In 2022,deliver care with our operators effectively managedown workforce via best-in-class contract labor costs while balancing access to caremanagement and improving clinical qualitystrong hiring results through local partnerships with nursing and patient safety metrics. We have real-time, data-driven management systems that continue to enable operational excellence. allied health professional schools. For the year, Tenet’s consolidated adjusted EBITDA margin reached a multi-decade high above 17%.

Expanding Tenet’s ecosystem of high-quality physicians. We continue to enhance high-acuity clinical programs by continuing to invest in cardiovascular, neurosciences, surgical services, NICU and trauma across markets. Additionally, we opened a new 100-bed, state-of-the-art hospital in Fort Mill, South Carolina.

Conifer maintains favorable performance and expands its commercial pipeline. In 2022, Conifer maintained a nearly 28% Adjusted EBITDA margin while also growing third-party customer revenue by 10%. This was supported by Conifer’s performance on cash collections, coding quality, and other key metrics for its clients. We continue to optimize the efficiency and effectiveness of Conifer’s revenue cycle management services through automation and offshoring. Additionally, we continue to see increasing sales activity from our reinvestment in Conifer’s commercial capabilities.

Tenet continues to foster an ecosystemnetwork of physicians with a shared commitment to excellence. We continue to attract and retain a network of locally, regionally, and nationally recognized physicians who share our commitment to compliance,innovation, quality and safety, and patient experience. In 2022,2023, we welcomed more than 200nearly two hundred new physicians across medical and surgical specialties to our employed physician group. USPI also continued to increase the number ofwelcome new physician partners as well as overallnew physicians to its active medical staff.

Tenet continuesContinuing a purpose-driven approach to embrace a diverse workforce that represents the communities we serve. We have continued to invest in our workforce with increased and competitive pay, bonus programs, and incremental benefits. Senior administrative and clinical leaders, including physician leaders, across our portfolio are engaged in retention and recruitment efforts which are yielding positive results. Nursing hires increased in 2022 over 2021. Additionally, both nurse turnover and overall turnover continued to improve throughout 2022. We remain steadfast in our goal of building a high-caliber, diverse workforce that represents the communities we serve and are committed to caring for patients.

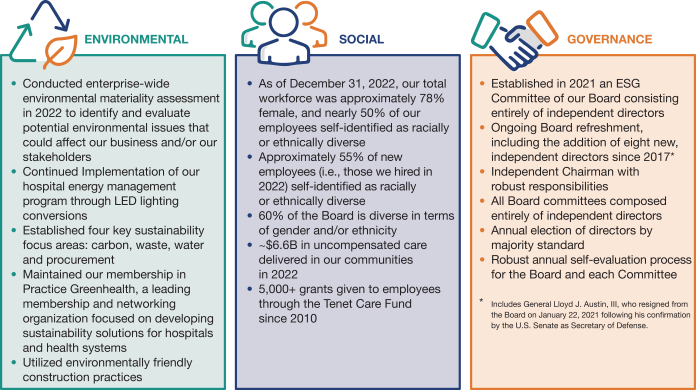

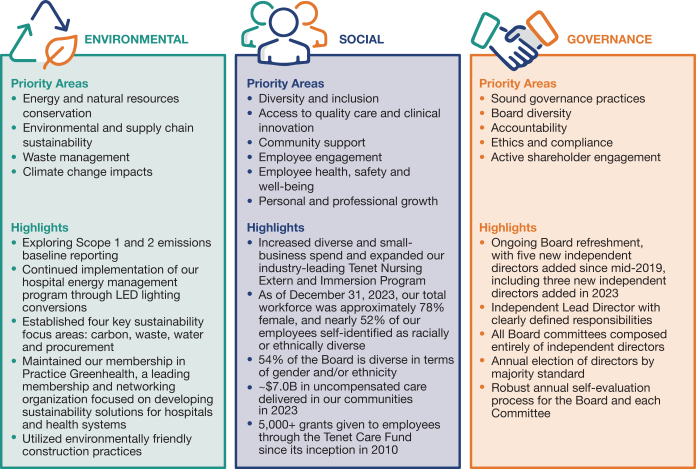

Environmental, Social, and Governance (ESG) continues to be purpose-driven.corporate responsibility. We continue to advance our programs that support the key tenetsaspects of ESG,corporate responsibility, with focus and Board oversight. In 2022, we advanced our diversity recruitment and hiring approach, continued to deploy enterprise-wide inclusive culture training, progressed hospital energy management programs, and maintained strong corporate governance policies and practices to protect the long-term interests of our shareholders. Our 20232024 ESG report will share details of steps we are takingour approach to foster a diverse and inclusive culture, strengthen the health of our communities, balance the needs of our patients with the goals of improvedsupport climate sustainability, lead with integrity, and apply sound governance.

Leadership remains committed toMaintaining a high-performance culture. In 2022,2023, we lost our former Executive Chairman, Ron Rittenmeyer. As many of you know, Ron was deeply committed to Tenet and ensured a seamless management transition which was largely completed in late 2021. We have assembled aof our Chief Financial Officer from Daniel Cancelmi to Sun Park, consistent with our expectations. Our high-performing leadership team that will continuecontinues to drive strategic priorities, taking a data-driven and theoutcomes-focused approach. Furthermore, our organization promotes a culture of quality, safety, and compliance.

I am enthusiastic about

The accomplishments of 2023 reflect the trajectorycollective effort and dedication of our well-positioned businesses.entire team. I would like to extend my sincere gratitudeappreciation to all our physicians, caregivers, and staff for their unwavering commitment. I continuesteadfast commitment to be inspired by the people I meet who have found their calling to provide innovative andproviding high-quality, compassionate care for our communities. I amOn behalf of Tenet’s Board of Directors and leadership team, we are grateful for the support of our shareholders and our partners as we continue to fulfillpursue our valuable mission.

Respectfully,

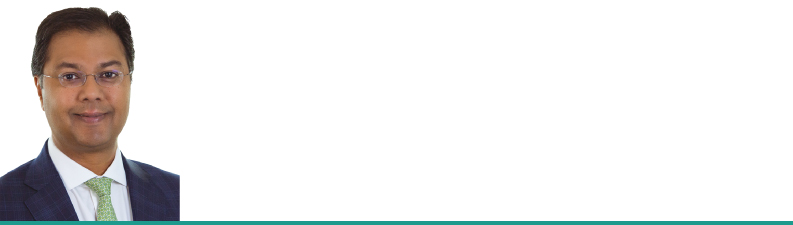

Saum Sutaria, M.D. Chairman and Chief Executive Officer Tenet Healthcare |

|

|

TENET HEALTHCARE CORPORATION

14201 Dallas Parkway

Dallas, Texas 75254

(469) 893-2200

Notice of Annual Meeting of Shareholders to be held on Thursday,Wednesday, May 25, 202322, 2024

April 14, 202312, 2024

To our Shareholders:

Our 20232024 Annual Meeting of Shareholders (the “Annual Meeting”) will be held on May 25, 2023,22, 2024, at 8:00 a.m. Central Time. You will be able to attend and participate in the Annual Meeting by registering at www.proxydocs.com/THC. After you complete your registration, you will receive further instructions via email, including a unique link that will provide you access to the Annual Meeting, where you will be able to listen to the meeting live, submit questions and vote. Our Annual Meeting is being held for the following purposes:

| 1. | To elect the |

| 2. | To vote, on an advisory basis, to approve the Company’s executive compensation. |

| 3. | To |

|

To vote on |

We will also consider and take action on any other business that properly comes before the meeting or any adjournment or postponement of the meeting.

Only shareholders of record of our common stock at the close of business on March 28, 202327, 2024 are entitled to notice of and to vote at the Annual Meeting.

It is important that your shares be represented and voted at the Annual Meeting. You may vote your shares via the Internet, by telephone or by completing and returning a proxy card. Specific voting instructions are set forth in the “General Information Regarding the Annual Meeting and Voting” section of the accompanying Proxy Statement and on the proxy card.

|

| Thomas W. Arnst |

| Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary |

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to be held on May 25, 202322, 2024

The accompanying Proxy Statement and the Company’s proxy card, as well as our Annual

Report on Form 10-K for the year ended December 31, 2022,2023, are available at www.proxydocs.com/THC.

We have adopted a virtual meeting format for our Annual Meeting, conducted via a live audio webcast. You will be able to attend the Annual Meeting online, listen to the meeting live, submit questions and vote your shares electronically during the meeting by registering at www.proxydocs.com/THC. We have designed the format of the Annual Meeting to provide shareholders with substantially the same rights and opportunities to participate as they would at an in-person meeting. As always, we encourage you to vote your shares prior to the Annual Meeting.

|

Table of Contents

| Proxy Statement Summary | 1 | ||||||

| Proposal 1 - Election of Directors | 6 | ||||||

| Corporate Governance and Board Practices | |||||||

Commitment to Sound Corporate Governance Policies and Practices | |||||||

Communications with the Board of Directors by Shareholders and Other Interested Parties | |||||||

| Director Compensation | |||||||

| Executive Officers | |||||||

| Securities Ownership | |||||||

| Compensation Discussion and Analysis | |||||||

| Human Resources Committee Report | |||||||

This Proxy Statement includes certain financial measures not in accordance with generally accepted accounting principles in the United States (GAAP), such as Adjusted EBITDA, Adjusted Free Cash Flow and Adjusted EPS. Definitions of these measures are contained in Appendix A to this Proxy Statement.

|

Proxy Statement Summary

Below are highlights of certain information in this Proxy Statement. Please refer to the complete Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 20222023 before you vote.

20232024 ANNUAL MEETING OF SHAREHOLDERS

|

|

|

| |||||||

Date and Time:

at 8:00 a.m. Central Time

|

| Place: Online by registering at www.proxydocs.com/THC

|

| Record Date: March

| ||||||

Information:

The Notice of Internet Availability, this Proxy Statement and related proxy materials are being mailed or made available to shareholders on or about April 14, 2023.12, 2024. Copies of this Proxy Statement, the Company’s proxy card and our Annual Report on Form 10-K for the year ended December 31, 20222023 are available at www.proxydocs.com/THC.

VOTING MATTERS AND BOARD RECOMMENDATIONS

Proposal |

| Board’s Recommendation | Page | |||||||||

Proposal |

| Board’s Recommendation | Page | |||||||||

1 | ||||||||||||

1 |

Election of Ten Director Nominees |

Vote FOR Each Nominee |

6 |

Election of 13 Director Nominees |

Vote FOR Each Nominee |

6 | ||||||

2 |

Advisory Approval of the Company’s Executive Compensation |

Vote FOR |

71 | |||||||||

2 |

Advisory Approval of the Company’s Executive Compensation |

Vote FOR |

78 | |||||||||

3 | ||||||||||||

3 |

Advisory Approval of the Frequency of Future Advisory Votes to Approve the Company’s Executive Compensation |

Vote ONE YEAR |

72 |

Ratification of the Selection of Deloitte & Touche LLP as Independent Registered Public Accountants for the Year Ending December 31, 2024 |

Vote FOR |

81 | ||||||

4 |

Ratification of the Selection of Deloitte & Touche LLP as Independent Registered Public Accountants for the Year Ending December 31, 2023 |

Vote FOR |

75 | |||||||||

4 |

Shareholder Proposal to Report on Risk Mitigation Regarding State Restrictions for Emergency Abortions |

Vote AGAINST |

82 | |||||||||

5 |

Shareholder Proposal on Requesting a Report on Patients’ Right to Access Abortion in Emergencies |

Vote AGAINST |

76 | |||||||||

5 |

Shareholder Proposal to Report on Plans to Integrate ESG Metrics Into Executive Compensation |

Vote AGAINST |

84 | |||||||||

2024 PROXY STATEMENT |

Proxy Statement Summary

Business Overview

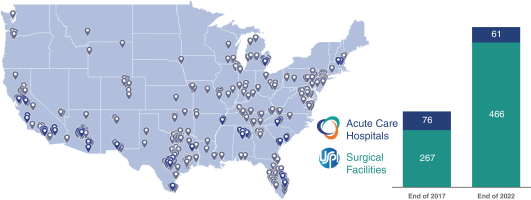

Tenet is a diversified healthcare services company focused on our mission to provide quality, compassionate care in the communities we serve. At December 31, 2022,2023, Tenet had approximately 102,400106,500 employees delivering and supporting care through our threetwo business segments — Hospital Operations and other,Services (Hospital Operations) and Ambulatory CareCare. As of December 31, 2023, our Hospital Operations segment was comprised of our 61 acute care and Conifer. We operate an expansivespecialty hospitals, a network across the country, with 61 hospitalsof employed physicians and over 575 other healthcare164 outpatient facilities, including surgical hospitals, ambulatory surgery centers, imaging centers, urgent care centers, ancillary emergency facilities and off-campusmicro-hospitals. emergency departments and micro-hospitals. Through our subsidiary United Surgical Partners International, Inc. (USPI), Tenet operates a leading ambulatory surgery platform that includes partnerships with over 50 health system partners. In addition, our Conifer Health Solutions, LLC subsidiaryOur Hospital Operations segment also provides comprehensive end-to-end and focused-point business process services, including hospital and physician revenue cycle management patient communications and engagement support, and value-based care solutions,services to hospitals, health systems, physician practices, employers and other clients.clients through our Conifer Health Solutions, LLC joint venture. Our Ambulatory Care segment is comprised of the operations of our subsidiary USPI Holding Company, Inc. (USPI), which held indirect ownership interests in 461 ambulatory surgery centers and 24 surgical hospitals at December 31, 2023.

Repositioned Care Delivery Portfolio

A critical element of our strategy remainsWe continue to execute on the ongoing transformation of our care delivery offerings. We continue to invest strategicallyStrategic investments in USPI establishingremain a top priority, and we established new ownership positions in approximately 4530 ambulatory surgery centers in 2022.2023. We also continue our strategic deployment of capital to enhance high-acuity hospital services. Our efforts include capacity expansion, new construction in high-growth, attractive locations and investments in innovation. Additionally, we announced the sale of certain hospitals in order to further deleverage, strengthen our balance sheet and provide enhanced financial flexibility. Across our comprehensive network of facilities, we are focused on introducing new services at a lower cost and offering patients excellent service in the most clinically appropriate setting. The evolution of our care delivery locations since 2017 reflects our strategy to invest strategically in USPI. Our focus is on markets where we can provide a strong value to consumers and payers, and consumers.the evolution of our care delivery locations reflects our strategy to grow USPI.

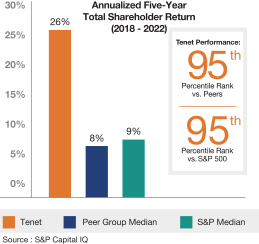

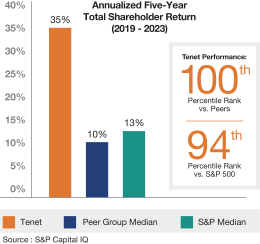

Strong Long-Term Performance

| 2 |

|

Proxy Statement Summary

|

Overview of Director Nominees

Name and Occupation | Age | Director Since | Independent | Other Public Boards | Committee Memberships | |||||||||||||||||||||||||||||||

| AC | ESG | HR | NCG | QCE | Name and Occupation | Age | Director Since | Independent | Other Public Boards | Committee Memberships | ||||||||||||||||||||||||||

| AC | ESG | HR | NCG | QCE | ||||||||||||||||||||||||||||||||

J. Robert Kerrey Chairman, Tenet Healthcare; Managing Director, Allen & Company; Former U.S. Senator | 79 | 2012* | Yes | Chair | ✓ | |||||||||||||||||||||||||||||||

Saumya Sutaria, M.D. Chairman and CEO, Tenet Healthcare | ||||||||||||||||||||||||||||||||||||

Saumya Sutaria, M.D. Chairman and CEO, Tenet Healthcare | 51 | 2020 | No | |||||||||||||||||||||||||||||||||

J. Robert Kerrey Lead Director, Tenet Healthcare; Managing Director, Allen & Company; Former U.S. Senator | ||||||||||||||||||||||||||||||||||||

J. Robert Kerrey Lead Director, Tenet Healthcare; Managing Director, Allen & Company; Former U.S. Senator | 80 | 2012* | Yes | Chair | ✓ | |||||||||||||||||||||||||||||||

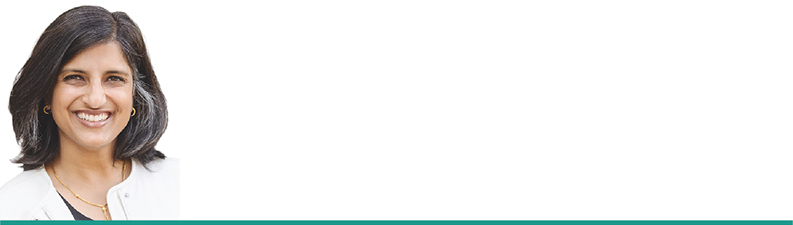

Vineeta Agarwala, M.D., PhD General Partner, Andreessen Horowitz (a16z) | ||||||||||||||||||||||||||||||||||||

Vineeta Agarwala, M.D., PhD General Partner, Andreessen Horowitz (a16z) | 37 | 2023 | Yes | ✓ | ✓ | |||||||||||||||||||||||||||||||

James L. Bierman Former President and CEO, Owens & Minor, Inc. | 70 | 2017 | Yes | 2 | ✓ | Chair | ||||||||||||||||||||||||||||||

James L. Bierman Former President and CEO, Owens & Minor, Inc. | 71 | 2017 | Yes | 2 | ✓ | Chair | ||||||||||||||||||||||||||||||

Roy Blunt Chairman, Leadership Advisory Strategies Group, Husch Blackwell Strategies; Former U.S. Senator; Former Member of the U.S. House of Representatives | ||||||||||||||||||||||||||||||||||||

Roy Blunt Chairman, Leadership Advisory Strategies Group, Husch Blackwell Strategies; Former U.S. Senator; Former Member of the U.S. House of Representatives | 74 | 2023 | Yes | 1 | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Richard W. Fisher Former President and CEO, Federal Reserve Bank of Dallas | 74 | 2017 | Yes | 1 | ✓ | Chair | ✓ | |||||||||||||||||||||||||||||

Richard W. Fisher Former President and CEO, Federal Reserve Bank of Dallas | 75 | 2017 | Yes | 1 | ✓ | Chair | ✓ | |||||||||||||||||||||||||||||

Meghan M. FitzGerald Adjunct Professor, Columbia University | 52 | 2018 | Yes | 1 | ✓ | Chair | ✓ | |||||||||||||||||||||||||||||

Meghan M. FitzGerald, DrPH Adjunct Professor, Columbia University | ||||||||||||||||||||||||||||||||||||

Meghan M. FitzGerald, DrPH Adjunct Professor, Columbia University | 53 | 2018 | Yes | 1 | ✓ | Chair | ✓ | |||||||||||||||||||||||||||||

Cecil D. Haney Admiral, U.S. Navy (Ret.) and Former Commander of U.S. Strategic Command and U.S. Pacific Fleet | ||||||||||||||||||||||||||||||||||||

Cecil D. Haney Admiral, U.S. Navy (Ret.) and Former Commander of U.S. Strategic Command and U.S. Pacific Fleet | 67 | 2021 | Yes | 1 | ✓ | ✓ | 68 | 2021 | Yes | 1 | ✓ | ✓ | ||||||||||||||||||||||||

Christopher S. Lynch Former National Partner in Charge of the Financial Services practice at KPMG, LLC | 65 | 2019 | Yes | 1 | ✓ | ✓ | ||||||||||||||||||||||||||||||

Christopher S. Lynch Former National Partner in Charge of the Financial Services practice at KPMG, LLC | 66 | 2019 | Yes | 1 | ✓ | ✓ | ||||||||||||||||||||||||||||||

Richard J. Mark Former Chairman and President, Ameren Illinois Company | ||||||||||||||||||||||||||||||||||||

Richard J. Mark Former Chairman and President, Ameren Illinois Company | 67 | 2017 | Yes | ✓ | ✓ | ✓ | 68 | 2017 | Yes | 1 | ✓ | ✓ | ✓ | |||||||||||||||||||||||

Tammy Romo Executive Vice President and CFO, Southwest Airlines Co. | 60 | 2015 | Yes | Chair | ✓ | |||||||||||||||||||||||||||||||

Tammy Romo Executive Vice President and CFO, Southwest Airlines Co. | 61 | 2015 | Yes | Chair | ✓ | |||||||||||||||||||||||||||||||

Saumya Sutaria, M.D. CEO, Tenet Healthcare | 50 | 2020 | No | |||||||||||||||||||||||||||||||||

Stephen H. Rusckowski Former Chairman, CEO and President, Quest Diagnostics Incorporated | ||||||||||||||||||||||||||||||||||||

Stephen H. Rusckowski Former Chairman, CEO and President, Quest Diagnostics Incorporated | 66 | 2023 | Yes | 2 | ✓ | ✓ | ||||||||||||||||||||||||||||||

Nadja Y. West, M.D. Lieutenant General, U.S. Army (Ret.) and 44th Surgeon General of the U.S. Army | 62 | 2019 | Yes | 2 | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Nadja Y. West, M.D. Lieutenant General, U.S. Army (Ret.) and 44th Surgeon General of the U.S. Army | ||||||||||||||||||||||||||||||||||||

Nadja Y. West, M.D. Lieutenant General, U.S. Army (Ret.) and 44th Surgeon General of the U.S. Army | 63 | 2019 | Yes | 2 | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

AC: Audit Committee ESG: Environmental, Social and Governance Committee | HR: Human Resources Committee NCG: Nominating and Corporate Governance Committee | QCE: Quality, Compliance & Ethics Committee ✓ = Member |

| * | Senator Kerrey served as a director from March 2001 to March 2012 prior to his appointment in November 2012. |

2024 PROXY STATEMENT | 3 |

Proxy Statement Summary

Director Nominees’ Experience and Diversity

Having an independent Board is a core element of our governance philosophy. Under our Corporate Governance Principles, at least two-thirds of the Board must consist of independent directors. Of our 1013 Board nominees, 912 are independent in accordance with the requirements set forth in our Corporate Governance Principles. Moreover, our Board believes that having a diverse mix of directors with complementary qualifications, expertise and attributes is essential to meeting its oversight responsibility. The following highlights the core skills and experience of our Board nominees:

| Executive Leadership

| | Regulatory and Public Sector

| |||||||||||||||||||||||||||||||||||||||||||||||||

| 10 |

|

|

|

|

|

|

|

|

| 6 |

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||

|

Healthcare Industry |

|

|

|

|

|  | Public Company Board Service |

| |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7 |

|

|

| |||||||||||||||||||||||||||||

| Accounting and Finance |

|

|

|

|

|  |

Cybersecurity and Information Technology |

| |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| 5 |

|

|

|

|

|

|

|

|

|

| 2 |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||

|

Crisis and Risk Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||

|

|

|

|

|

| 5 |

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||

| Executive Leadership | | Regulatory and Public Sector | |||||

| lllllllllllll 13 | lllllllll 9 | |||||||

| Healthcare Industry | | Public Company Board Service | |||||

| lllllll 7 | llllllllll 10 | |||||||

| Accounting and Finance | | Cybersecurity and Information Technology | |||||

| lllll 5 | lll 3 | |||||||

| Crisis and Risk Management | |||||||

| lllllll 7 |

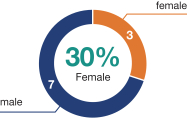

Tenet’s Board refreshment activities have cultivated a balanced mix of diversity, age, tenure and viewpoints in the boardroom. The Board believes that a range of backgrounds, viewpoints, beliefs, ethnicities and ages, in addition to gender diversity, contributes to strong governance and successful oversight of the Company.

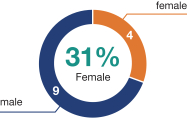

| Board Diversity | Gender Diversity | Ethnic Diversity | ||

|   |   |

Age Distribution | Tenure | |

|

|

| 4 |

|

Proxy Statement Summary

|

Corporate Governance and Board Practices

| • 12 of | |||||

| •All committee chairs and members are independent | |||||

| Highly diverse and experienced Board | |||||

| Annual self-evaluation of all directors using third-party facilitator | |||||

| Regular executive sessions of independent directors for Board and committee meetings | |||||

| All Audit Committee members have been designated as financially literate within the meaning of the New York Stock Exchange listing standards, and three members are audit committee financial experts under the Securities and Exchange Commission rules | |||||

| Commitment to Board refreshment practices, | |||||

| mid-2019, including three new independent directors added in 2023

| Board and | |||||

| • “Overboarding” limits for directors | |||||

| Board oversight of political contributions | |||||

| Board-level oversight of ESG matters and | |||||

| Annual review of Corporate Governance Principles | |||||

| Anti-hedging and anti-pledging policy | |||||

| Active shareholder outreach and engagement with feedback regularly reviewed by | |||||

RIGHTS | •Annual election of directors | |||||

| Shareholder right to call special meetings at 25% threshold | |||||

| Proxy access with market standard terms | |||||

| One-year limit on “poison pills” unless approved by shareholders | |||||

| Single class of stock with equal voting rights | |||||

| Majority vote standard and director resignation policy in uncontested elections | |||||

|

2024 PROXY STATEMENT | 5 |

Proposal 1 - Election of Directors

Nominees for Election to the Board of Directors

Tenet’s Board of Directors is elected annually by our shareholders. Our nominees for election include nine12 independent directors and our Chief Executive Officer. The Board has selected the nominees that follow to serve as directors until the 20242025 annual meeting, or until their successors are elected or appointed. Each of the nominees, other than Dr. Agarwala, Senator Blunt, Mr. Rusckowski, was last elected by the Company’s shareholders at the 20222023 annual meeting of shareholders. The nominees for director will be elected if the votes cast for the nominee exceed the votes cast against the nominee, with abstentions and broker non-votes not counted either for or against a nominee.

| The Board recommends that you vote “FOR” the election of each of the following nominees. |

| 6 |

|

Director Nominees

Saumya Sutaria, M.D. | 51

| ||||

|

Tenet Healthcare Corporation | Director Since 2020 | ||

Board Committees None | Independent No | |||

Career Highlights:

| • | Dr. Sutaria was appointed Chairman of the Board in August 2023. He was appointed as the Company’s Chief Executive Officer in September 2021, and as a member of the Board in November 2020. |

| • | Prior to becoming Chief Executive Officer, he served as the Company’s Chief Operating Officer from January 2019 to September 2021 and President from November 2019 to September 2021. |

| • | Before joining the Company, Dr. Sutaria worked for McKinsey & Company, a global management consulting firm, for 18 years, most recently as a Senior Partner providing advisory support for hospitals, healthcare systems, physicians groups, ambulatory care models, integrated delivery, and government-led delivery, while also working with institutional investors in healthcare. |

| • | He previously held an associate clinical faculty appointment at the University of California at San Francisco, where he also engaged in postgraduate training with a focus in internal medicine and cardiology. |

| • | Dr. Sutaria received his Bachelor’s Degree in molecular and cellular biology and his Bachelor’s Degree in economics, both from the University of California, Berkeley, as well as his Medical Degree from the University of California, San Diego. |

Skills and Qualifications:

| • | Dr. Sutaria brings tremendous experience in healthcare leadership both within Tenet and prior to joining Tenet in 2019. |

| • | The Board values his strategic prowess in navigating complex matters, his ability to thoughtfully consider the impact on different stakeholders and his innate capacity for effective change management. |

2024 PROXY STATEMENT | 7 |

Director Nominees

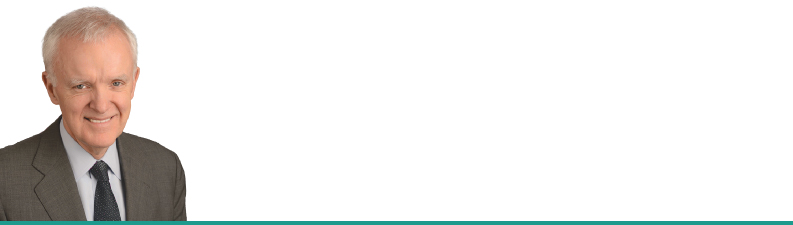

J. Robert Kerrey | 80 Lead Director | ||||

Managing Director Allen & Company Former U.S. Senator | Director Since March 2012* | |||

Board Committees Human Resources (Chair) Quality, Compliance & Ethics | Independent Yes | |||

Career Highlights:

| • | Senator Kerrey is a former governor and U.S. Senator from Nebraska. |

| • | He has served as managing director at Allen & Company, an investment banking firm, since 2014. |

| • | He has also served as Executive Chairman of The Minerva Institute for Research and Scholarship, a non-profit that offers exceptional educational experiences to students and advances faculty research, since 2013. |

| • | From 2011 to 2013, he was President Emeritus of The New School University in New York City, where he served as President from 2001 to 2010. |

| • | From 2011 to 2012, he served as the Chairman of M & F Worldwide Education Holdings. |

| • | From 1989 to 2000, he served as a U.S. Senator for the State of Nebraska. |

| • | Previously, Senator Kerrey was Governor of the State of Nebraska from 1982 to 1987. |

| • | Prior to public service, he founded and operated a chain of restaurants and health clubs. |

| • | A former member of the elite Navy SEAL Team, Senator Kerrey is a highly decorated Vietnam veteran who was awarded the Congressional Medal of Honor – America’s highest military honor. |

| • | He holds a degree in pharmacy from the University of Nebraska. |

Skills and Qualifications:

Skills and Qualifications:

| • | Senator Kerrey’s 18 years of experience in the public sector as a former U.S. Senator and Governor of Nebraska provide a key perspective to the Board in the highly regulated healthcare industry. |

| • | Further, he has extensive experience in finance and public policy from his service at the investment banking firm Allen & Company and as a leader of a major university. |

| • | The Board also values Senator Kerrey’s prior service on public company boards and crisis management. |

Prior Public Company Directorships Within the Past Five Years:

Lux Health Tech Acquisition Corp. |

| * | Senator Kerrey served as a director from March 2001 to March 2012 prior to his appointment in November 2012. | |

|

Director Nominees

|

|

|

Vineeta Agarwala, M.D., PhD | 37 | ||||

General Partner Andreessen Horowitz (a16z) | Director Since 2023 | |||

Board Committees Human Resources Quality, Compliance & Ethics | Independent Yes | |||

Career Highlights:

| • | Since January 2020, Dr. Agarwala has served as a General Partner at Andreessen Horowitz (a16z), where she leads investments for the firm’s Bio + Health fund across biotech and digital health. |

| • | In addition, she has served as an Adjunct Clinical Assistant Professor at Stanford University School of Medicine since 2020. |

| • | From August 2016 to June 2018, Dr. Agarwala served as Director of Product Management at Flatiron Health, where she led the company’s partnership with Foundation Medicine to integrate real-world clinical and genomic data into national-scale data products to accelerate research and development in oncology. |

| • | Between March 2015 and December 2019, she was a venture investor on the GV (Google Ventures) life sciences team. |

| • | Dr. Agarwala holds M.D. and Ph.D. degrees from Harvard Medical School / MIT, and a B.S. degree in biophysics from Stanford University. |

| • | She completed her clinical residency at Stanford and is board certified in internal medicine. |

Skills and Qualifications:

| • | Dr. Agarwala brings to the Board a broad range of experience in the healthcare industry, including her clinical background and as an investor focused on partnering with companies leveraging unique technologies and datasets to advance drug development, personalized medicine, and novel approaches to patient care delivery. |

| • | In addition to her experience in a variety of healthcare positions, the Board values Dr. Agarwala’s expertise in innovative technologies, including applications of artificial intelligence. |

2024 PROXY STATEMENT | 9 |

Director Nominees

James L. Bierman| 71

| ||||||

|

Owens & Minor, Inc. | Director Since 2017 | ||||

Board Committees Nominating and Corporate Governance Quality, Compliance & Ethics (Chair) | Independent Yes | |||||

Career Highlights:

| • | Mr. Bierman served as President and Chief Executive Officer of Owens & Minor, Inc., a Fortune 500 company and a leading distributor of medical and surgical supplies, from September 2014 to June 2015. |

| • | Previously, he served in various other senior roles at Owens & Minor, including President and Chief Operating Officer from August 2013 to September 2014, Executive Vice President and Chief Operating Officer from March 2012 to August 2013, Executive Vice President and Chief Financial Officer from April 2011 to March 2012, and |

| • | From 2001 to 2004, Mr. Bierman served as Executive Vice President and Chief Financial Officer at Quintiles Transnational Corp. Prior to joining Quintiles Transnational, |

| • | Mr. Bierman earned his B.A. from Dickinson College and his M.B.A. from Cornell University’s Johnson Graduate School of Management. |

Skills and Qualifications:

Skills and Qualifications:

| • | Mr. Bierman brings to the Board the skillsets he developed serving in multiple leadership positions at Owens & Minor, Inc., including as Chief Executive Officer. |

| • | The Board values his significant operational and financial experience in the healthcare industry. |

Other Current Public Company Directorships:

MiMedx Group, Inc. |

Prior Public Company Directorships Within the Past Five Years:

KL Acquisition Corp. |

| • | Novan, Inc. |

| 10 |

|

Director Nominees

Roy Blunt | 74 | ||||

Chairman of Leadership Advisory Strategies Husch Blackwell Strategies Former U.S. Senator | Director Since 2023 | |||

Board Committees Audit ESG Nominating and Corporate Governance | Independent Yes | |||

Career Highlights:

| • | Senator Blunt has served as the Chairman of the Leadership Advisory Strategies group at Husch Blackwell Strategies since April 2023. |

| • | From 2011 to 2023, he served as a U.S. Senator for the State of Missouri. This includes service as Chairman of the Senate Rules Committee, as well as serving on the Senate Appropriations Committee, Senate Commerce, Science and Transportation Committee, and the Senate Select Committee on Intelligence. |

| • | He served as a member of the U.S. House of Representatives from 1997 to 2011, representing Missouri’s 7th Congressional District. |

| • | Prior to his tenure in Congress, Senator Blunt served four years as the president of Southwest Baptist University from 1993 to 1996. |

| • | Senator Blunt also served as Missouri’s Secretary of State from 1985 to 1993. |

Skills and Qualifications:

| • | Senator Blunt’s distinguished career as an elected official, government executive and legislator, including his 25 years of experience as a former U.S. Senator and member of the U.S. House of Representatives, provides a valuable perspective to the Board on government, regulatory and public policy issues. |

| • | The Board also values Senator Blunt’s leadership experience, which includes advising U.S. Presidents and helping to pass consequential legislation for the country in healthcare and national security. |

Other Current Public Company Directorships:

| • | Southwest Airlines Co. |

2024 PROXY STATEMENT | 11 |

Director Nominees

Richard W. Fisher| 75

| ||||||

Federal Reserve Bank of Dallas | Director Since 2017 | |||||

Board Committees Audit ESG (Chair) Human Resources | Independent Yes | |||||

Career Highlights:

| • | Mr. Fisher served as President and Chief Executive Officer of the Federal Reserve Bank of Dallas from 2005 until 2015. During his tenure, he served as a member of the Federal Open Market Policy Committee, as the chair of the Conference of Federal Reserve Bank Presidents, and as the chair of the Information Technology Oversight Committee for the 12 Federal Reserve banks. |

| • | Previously, from 2001 to 2005, |

| • | From 1997 to 2001, Mr. Fisher served as Deputy U.S. Trade Representative with the rank of Ambassador. |

| • | From 2015 to 2024, he served as a Senior Advisor for Barclays PLC, a leading investment bank, and as a Trustee of the University of Texas Southwestern Medical Foundation. |

| • | Mr. Fisher received his B.A. in economics from Harvard University and earned his M.B.A. from Stanford University. |

Skills and Qualifications:

Skills and Qualifications:

| • | Mr. Fisher offers valuable financial and policy perspectives from his experience as President and Chief Executive Officer of the Dallas Federal Reserve. |

| • | The Board values his insight in public finance, trade, technology and risk management. |

Other Current Public Company Directorships:

Warner Bros. Discovery, Inc. |

Prior Public Company Directorships Within the Past Five Years:

AT&T Inc. | ||

| ||

| • | Beneficient |

| • | PepsiCo, Inc. |

|

Director Nominees

Meghan M. FitzGerald, DrPH| 53 | ||||

|

Columbia University | Director Since 2018 | ||

Board Committees ESG Nominating and Corporate Governance (Chair) Quality, Compliance & Ethics | Independent Yes | |||

Career Highlights:

| • | Ms. FitzGerald is a private equity investor, |

| • | In addition, |

| • | Ms. FitzGerald served from December 2016 to January 2020 as the CEO and managing partner at Letter One’s inaugural health vehicle. |

| • | Prior to that, she served for nearly 20 years as an operator and strategist working for many healthcare firms, including Merck, Pfizer and Medco. |

| • | From May 2015 to October 2016, Ms. FitzGerald served as Executive Vice President of Strategy and Policy at Cardinal Health, a healthcare services and product company. From 2010 to 2015, she served as President of Cardinal’s Specialty Solutions division. |

| • | Ms. FitzGerald also previously served as a director of Thimble Point Acquisition Corp. from February to December 2021 and Arix Bioscience plc from 2017 to 2019. |

| • | She is the founder of K2HealthVentures, a life science investment fund. |

| • | She holds a DrPH in Healthcare Policy from New York Medical College, a BSN in Nursing from Fairfield University, and a Master of Public Health from Columbia University. |

Skills and Qualifications:

Skills and Qualifications:

| • | Ms. FitzGerald brings to the Board a broad range of experience in the healthcare industry, including senior strategic leadership, public policy, care delivery from her service as a nurse, and transactions and investments in a variety of healthcare fields from technology to life sciences. |

Other Current Public Company Directorships:

Roivant Sciences Ltd. |

Prior Public Company Directorships Within the Past Five Years:

Thimble Point Acquisition Corp. | ||

2024 PROXY STATEMENT | 13 |

Director Nominees

Cecil D. Haney| 68

| ||||||

|

U.S. Navy | Director Since 2021 | ||||

Board Committees Audit Nominating and Corporate Governance | Independent Yes | |||||

Career Highlights:

| • | Admiral Haney is a retired four-star Admiral, who completed 38 years of service in the U.S. Navy in 2017. |

| • | Between 2013 and 2016, he also served as commander of the U.S. Strategic Command, where he was responsible for strategic capabilities involving nuclear forces, missile defense, space and cyberspace. |

| • | In addition, between 2012 and 2013, he also served as commander of the U.S. Pacific Fleet, leading the U.S. Navy’s operations and the manning, operations and maintenance of the U.S. Navy fleet located in the Pacific and Indian oceans. |

| • | He currently serves on the Johns Hopkins University Applied Physics Board of Managers, the Penn State University Applied Research Lab Advisory Board, the Naval Studies Board, the Aerospace Corporation Board of Trustees, and the Board of Directors for General Dynamics Corporation, Systems Planning and Analysis Inc., and the Center for New American Security. |

| • | He also serves as Chairman of the Board of Directors for the Military Child Education Coalition. |

| • | Admiral Haney is a graduate of the U.S. Naval Academy and holds Master’s degrees in National Security Strategy from the National Defense University and in Engineering Acoustics and System Technology from the Naval Post Graduate School. |

Skills and Qualifications:

Skills and Qualifications:

| • | The Board values Admiral Haney’s leadership experience as a former four-star Admiral in the U.S. Navy. |

| • | He brings to the Board valuable insights into cybersecurity, systems planning, and crisis and risk management. |

Other Current Public Company Directorships:

| • |

General Dynamics Corporation | |

|

Director Nominees

|

|

|

Christopher S. Lynch| 66

| ||||

KPMG, LLC | Director Since 2019 | |||

Board Committees Audit Human Resources | Independent Yes | |||

Career Highlights:

| • | Mr. Lynch served as National Partner in Charge of the Financial Services practice at KPMG, LLC from 2004 until his retirement in 2007. |

| • | Prior to that, Mr. Lynch held a variety of positions at KPMG during his 29-year tenure, including chair of KPMG’s Americas Financial Services Leadership team and a member of the Global Financial Services Leadership and U.S. Industries Leadership teams. |

| • | From 2009 to 2022, he served as an independent director of American International Group, Inc. (AIG). |

| • | From 2008 to 2019, he also served as an independent director of Freddie Mac and was the Non-Executive Chairman of the Board from 2011 to 2018. |

| • | Mr. Lynch has chaired audit committees of both AIG and Freddie Mac and has relevant committee experience on Risk, Compensation, Nomination and Corporate Governance and Technology. |

| • | Mr. Lynch is a former member of the Advisory Board of the Stanford Institute for Economic Policy Research and a member of the Audit Committee Chair Advisory Council of the National Association of Corporate Directors. |

| • | He received a Bachelor of Science in Accounting and Business Administration from the University of Kansas. |

Skills and Qualifications:

Skills and Qualifications:

| • | The Board values Mr. Lynch’s deep accounting, financial and corporate governance experience, including serving in leadership positions at KPMG and chairing audit committees at two highly regulated public companies. |

Other Current Public Company Directorships:

Corebridge Financial, Inc. |

Prior Public Company Directorships Within the Past Five Years:

American International Group, Inc. |

| • | Federal Home Loan Mortgage Company (Freddie Mac) |

2024 PROXY STATEMENT | 15 |

Director Nominees

Richard J. Mark | 68

| ||||

| ||||

| ||||

Ameren Illinois Company | Director Since 2017 | |||

Board Committees Audit ESG Human Resources | Independent Yes | |||

Career Highlights:

| • | Mr. Mark retired in August 2022 as Chairman and President of Ameren Illinois Company, a multi-billion dollar energy and utility company responsible for electric and natural gas distribution to more than 1.2 million electric and 800,000 natural gas customers in Illinois. |

| • | Mr. Mark joined Ameren in 2002 as Vice President of Customer Service before moving up to various senior management roles. |

| • | Before joining Ameren, he served for 11 years at Ancilla Systems Inc. While at Ancilla, the parent company to St. Mary’s Hospital in East St. Louis, Illinois, he served as Vice President for Governmental Affairs and Chief Operating Officer before becoming Chief Executive Officer of St. Mary’s Hospital in East St. Louis, Illinois from 1994 to 2002. |

| • | Mr. Mark served as Director of Union Electric Company from 2005 until 2012 and was Chairman of Ameren Illinois (both subsidiaries of Ameren Corporation) from 2012 to 2022. |

| • | Mr. Mark earned his B.S. from Iowa State University and his M.S. from National Louis University. |

Skills and Qualifications:

Skills and Qualifications:

| • | Mr. Mark offers the Board extensive experience as former Chairman and President of Ameren Illinois, a company in a highly regulated industry, in addition to multiple leadership positions at an acute care hospital, including service as Chief Executive Officer. |

Other Current Public Company Directorships:

| • | Sempra |

| ||||

|

Director Nominees

| ||||

Executive Vice President & CFO Southwest Airlines Co. | Director Since 2015 | |||

Board Committees Audit (Chair) Human Resources | Independent Yes | |||

Career Highlights:

| • | Ms. Romo is Executive Vice President and Chief Financial Officer of Southwest Airlines Co., a major passenger airline, where she is responsible for strategic planning and overall finance activities, including reporting, accounting, investor relations, treasury, tax, corporate planning, and financial planning and analysis. She also oversees supply chain management. |

| • | Ms. Romo previously served in a number of financial management and leadership positions at Southwest Airlines, including Senior Vice President of Planning, Vice President and Controller, Vice President and Treasurer, and Senior Director of Investor Relations. |

| • | Before joining Southwest Airlines in 1991, Ms. Romo was an audit manager at Coopers & Lybrand, LLP. |

| • | Ms. Romo is currently a member of the McCombs School of Business Advisory Council at the University of Texas at Austin. |

| • | She received a B.B.A. in accounting from the University of Texas at Austin, and she is a Certified Public Accountant in the State of Texas. |

Skills and Qualifications:

Skills and Qualifications:

| • | Ms. Romo brings to the Board her experience as Executive Vice President and Chief Financial Officer of Southwest Airlines, where she oversees a broad range of financial activities. |

| • | The Board values her deep knowledge of accounting and financial matters, in addition to her understanding of risk management. | |

| ||

| 17 |

Director Nominees

| ||||

Former Chairman, CEO and President Quest Diagnostics Incorporated | Director Since 2023 | |||

Board Committees Human Resources Quality, Compliance & Ethics | Independent Yes | |||

Career Highlights:

| • | Mr. Rusckowski served as |

| • | He also served as Chairman of the Board of Quest Diagnostics from January 2017 through March 2023. |

| • | From 2006 to 2012, Mr. Rusckowski served as the Chief Executive Officer of Philips Healthcare and a member of the Board |

| • | He joined Philips Healthcare when it acquired Agilent’s Healthcare Solutions Group in 2001 and was the CEO of Philips Imaging Systems business group before becoming Chief Executive Officer

| |

| ||

| • | Mr. Rusckowski earned a bachelor’s degree in mechanical engineering from Worcester Polytechnic Institute and a Master of Management Science from the Massachusetts Institute of Technology’s Sloan School of Management. |

Skills and Qualifications:

| • | Mr. Rusckowski offers the Board extensive executive experience as a former CEO, including expertise in strategic planning and operations, with multinational corporations operating in the healthcare industry. |

Other Current Public Company Directorships:

| • | Baxter International Inc. |

| • | Qiagen N.V. |

Prior Public Company Directorships Within the Past Five Years:

| • | Quest Diagnostics Incorporated |

|

Director Nominees

|

|

|

Nadja Y. West, M.D.| 63

| ||||

U.S. Army | Director Since 2019 | |||

Board Committees ESG Nominating and Corporate Governance Quality, Compliance & Ethics | Independent Yes | |||

Career Highlights:

| • | Dr. West is a retired Lieutenant General in the U.S. Army, the 44th Surgeon General of the U.S. Army and the former Commanding General of the U.S. Army Medical Command. |

| • | Previously, she served as Joint Staff Surgeon at the Pentagon, where she acted as chief medical advisor to the Chairman of the Joint Chiefs of Staff and coordinated all related health services issues, including operational medicine, force health protection, and readiness within the military. |

| • | Dr. West has served in combat deployment, as well as in leadership positions in multiple hospitals, both in the United States and abroad. |

| • | She is the recipient of numerous U.S. military awards, including the Distinguished Service Medal, the Defense Superior Service Medal, and the Legion of Merit with three Oak Leaf Clusters. |

| • | She has served as an independent director of Nucor Corporation since 2019 and Johnson & Johnson since 2020. |

| • | Dr. West has served as a trustee on the Board of the National Recreation Foundation, a non-profit organization dedicated to enhancing the role of recreation as a positive force in improving the quality of life of youth, since 2019. |

| • | Dr. West is a graduate of the U.S. Military Academy and earned her medical degree from The George Washington University School of Medicine in Washington, D.C. |

| • | She has completed residencies in both family medicine and dermatology. |

Skills and Qualifications:

Skills and Qualifications:

| • | The Board values Dr. West’s comprehensive experience in healthcare, including her service as the 44th Surgeon General of the U.S. Army. |

| • | Her experience in a variety of healthcare leadership positions and her clinical background offer the Board valuable perspectives on healthcare delivery, policy, and crisis and risk management. |

Other Current Public Company Directorships:

| • |

Johnson & Johnson | |

| ||

| • | Nucor Corporation |

2024 PROXY STATEMENT | 19 |

Proposal 1-Election of Directors

Director Nomination and Qualifications

Our Board regularly reviews its composition and is committed to recommending a group of directors who represent a diverse mix of viewpoints, skills, experience and backgrounds that align with the Company’s business and strategic goals. The Nominating and Corporate Governance Committee (Governance Committee) is responsible for nominating individuals, and the entire Board is responsible for selecting those who hold these characteristics to stand for shareholder election at each annual meeting, as well as to fill any vacancies on the Board as they arise.

Nomination Process

The Governance Committee considers candidates based on the recommendation of, among others, our Board members and our shareholders. The Governance Committee may also engage professional search firms and other consultants to assist in identifying, evaluating and conducting due diligence on potential candidates. We intend to continue to actively engage with our shareholders regarding Board composition and director qualifications, including considering their input on potential director candidates. Once potential candidates have been identified, they typically meet with each member of the Board and pass a thorough screening process before the Governance Committee makes a final recommendation to the Board. This process involves a rigorous evaluation that assesses attributes beyond specific business skills, including character, diversity, and personal and professional integrity.

Shareholders may propose nominees for election in accordance with the terms of our bylaws or recommend candidates for consideration by the Board by writing to the Governance Committee in care of the Corporate Secretary at Tenet Healthcare Corporation, 14201 Dallas Parkway, Dallas, Texas 75254, or by email to boardofdirectors@tenethealth.com. For more detailed information regarding the process by which shareholders may nominate directors, including under our proxy access provisions, please refer to “Other Information—Shareholder Proposals” below and our bylaws. Our bylaws may be found under the “Governance” heading in the “Investors”Investors section on our website at www.tenethealth.com*.

| * | Information included on our website and in any reports on our website shall not be deemed a part of, and is not incorporated by reference into, this Proxy Statement. |

CANDIDATE RECOMMENDATIONS |

|

GOVERNANCE COMMITTEE |

|

BOARD OF DIRECTORS |

|

SHAREHOLDERS | ||||||

| From Shareholders, Management, Directors, Professional Search Firms and Other Sources | Discusses and Reviews Board Needs Diversity Interviews Recommends Nominees | Discusses Governance Committee Recommendations Analyzes Independence Selects Nominees | Vote on Nominees at Annual Meeting | |||||||||

Assessment of Board Composition and Criteria for Board Membership

The Governance Committee evaluates the composition of the Board on an ongoing basis and considers potential nominees to the Board as appropriate. As part of this process, the Governance Committee reviews the composition of the Board as a whole, including the balance of business backgrounds, diversity, qualifications, skillsets and other qualities represented on the Board to provide the right balance to effectively oversee management. The Governance Committee also reviews updated biographical information for each incumbent director on an annual basis, including information relating to changes in professional status, independence, other professional commitments and public company directorships. In light of our current structure and

|

Proposal 1-Election of Directors

|

operations, and in consideration of the evaluation of the Board’s composition, the Governance Committee believes the following criteria should be represented on the Company’s Board:

| Professionalism, dedication, business judgment, integrity and commitment to the Company’s mission | Expertise in financial and accounting matters and familiarity with the regulatory and corporate governance requirements applicable to public companies | Service as the chief executive officer or in other senior leadership positions in a company or major governmental, professional or non-profit organization | |||||||||||||||||||||||||

Experience in the healthcare industry or other relevant industry experience | Diversity of personal and occupational backgrounds, including ethnicity, gender, experience and viewpoints | Government, regulatory and public sector experience | ||||||||||||||||||

Ability and willingness to commit adequate time to Board and committee matters | Degree to which the individual’s skills complement those of other directors and potential nominees | Familiarity with the communities in which we do business | ||||||||||||||||||

Board Evaluations

The Governance Committee oversees the Board’s annual performance evaluation to determine whether the Board, its committees and individual directors are functioning well in view of their responsibilities and the Company’s business. To conduct the self-evaluation process with greater transparency and rigor, the Board has for many years retained a third-party advisor to interview each director, review the directors’ collective feedback, and facilitate a discussion based on the results at a special executive session of the Board. This comprehensive and disciplined approach to evaluation has been an important element to maintaining a high-performing and collaborative Board that can properly address risk management and execution of Company strategy.

On an annual basis, the Board and each committee conduct self-evaluations. The evaluations focus discussions on, among other things, the composition and effectiveness of the Board in light of changes in membership, the effectiveness of Dr. Sutaria and Senator Kerrey as Chairman,in their respective leadership positions, and the performance of each committee and committee chair. The Chairman,Lead Director, in conjunction with the Governance Committee, also takes an oversight role in the Board performance evaluation process. In addition, directors provide input on key focus areas for the Board in the upcoming year. The results of the evaluation are reviewed by the Chairman,Lead Director, who reports the results to the Board. As part of the annual performance evaluation process, each committee also compares its performance with the requirements of its charter. As part of the Board’s last annual evaluation, the Board noted, among other things, that its processes and committees were functioning properly, noting healthy levels of debate, collaboration and respect among directors.

2024 PROXY STATEMENT | 21 |

Proposal 1-Election of Directors

Director Nominees’ Qualifications and Experience

Based on the review process described above, the Governance Committee concluded that our ten13 director nominees possess the diversity of experience, skills and other characteristics best suited to meet the needs of the Board and the Company in light of our current business and operating environment. The following table highlights several core skills and experiences of our current nominees, in addition to those described in the director biographies outlinedunder “Nominees for Election to the Board of Directors” beginning on page 6.

| Executive Leadership

| | Regulatory and Public Sector

| |||||||||||||||||||||||||||||||||||||||||||||||||

| 10 |

|

|

|

|

|

|

|

|

| 6 |

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||

|

Healthcare Industry |

|

|

|

|

|  | Public Company Board Service |

| |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7 |

|

|

| |||||||||||||||||||||||||||||

| Accounting and Finance |

|

|

|

|

|  |

Cybersecurity and Information Technology |

| |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

| 5 |

|

|

|

|

|

|

|

|

|

| 2 |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||

|

Crisis and Risk Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||

|

|

|

|

|

| 5 |

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||

| Executive Leadership | | Regulatory and Public Sector | |||||

| lllllllllllll 13 | lllllllll 9 | |||||||

| Healthcare Industry | | Public Company Board Service | |||||

| lllllll 7 | llllllllll 10 | |||||||

| Accounting and Finance | | Cybersecurity and Information Technology | |||||

| lllll 5 | lll 3 | |||||||

| Crisis and Risk Management | |||||||

| lllllll 7 |

Personal Qualities and Diversity. The Governance Committee determined that each nominee has demonstrated a commitment to professionalism and high integrity. In particular, the Governance Committee noted that each nominee has the ability to provide candid and direct feedback, as well as effective oversight of the Company’s operations and management, on behalf of all shareholders. Additionally, our Board includes a diverse group of individuals of differing ages, genders, ethnicities and backgrounds. ThreeFour of our ten13 director nominees are women, and in 2019 the Board appointed Ms. Romo and Ms. FitzGerald to chair our Audit and Governance committees, respectively.

Special Considerations Regarding Service on Other Boards. Our directors must seek the approval of the Governance Committee prior to serving on another public company’s board. In addition, the Governance Committee limits the number of public boards on which a director may serve in addition to our Board to three, or two in the case of directors currently serving as chief executive officers or in equivalent positions of public companies. All of the Company’s directors are in compliance with these requirements. Dr. Sutaria does not serve on any other public company board.

Director Independence

The independence requirements for our Board are set forth in our Corporate Governance Principles, available under the “Governance” heading in the “Investors”Investors section on our website at www.tenethealth.com*. Under our Corporate Governance Principles, at least two-thirds of the Board must consist of “independent” directors. The Board will not consider a director to be independent unless the Board affirmatively determines that the director has no material relationship with Tenet and the director otherwise qualifies as independent under the corporate governance standards of the New York Stock Exchange (NYSE). The Board reviews each director’s independence at least annually and has made the affirmative determination that the following non-employee directors have no material relationship with the Company and are independent: Senator Kerrey, Dr. Agarwala, Mr. Bierman, Senator Blunt, Mr. Fisher, Ms. FitzGerald, Admiral Haney, Mr. Lynch, Mr. Mark, Ms. Romo, Mr. Rusckowski and Dr. West. The only non-independent director who serves on our Board is our Chairman and Chief Executive Officer, Dr. Sutaria. In addition, the Board determined that Mr. Rittenmeyer, who served as our Executive Chairman until October 1, 2022, was a non-independent director.

In making its independence determinations, the Board broadly considers all relevant facts and circumstances and focuses on the organizations with which each director has an affiliation. If a director or member of the director’s immediate family has a material relationship with the Company, the Board reviews the interest to determine if it would preclude an independence determination.

The Audit Committee, the Human Resources Committee (HR Committee) and the Governance Committee are composed exclusively of independent directors as required by the NYSE. Additionally, the Environmental, Social and Governance (ESG) Committee and the Quality, Compliance & Ethics Committee (QCE Committee) are composed exclusively of independent directors. All directors serving on the Audit Committee meet the more stringent independence standards for audit committee members required by the Securities and Exchange Commission (SEC), and all directors serving on the HR Committee meet the more stringent independence standards for compensation committee members required by the NYSE.

|

|

Corporate Governance and Board Practices

Commitment to Sound Corporate Governance Policies and Practices

Tenet is committed to maintaining corporate governance policies and practices that protect the long-term interests of our shareholders and promote Board and management accountability. Our Board recognizes that this requires us to review and refine our corporate governance practices on an ongoing basis to continue to align with evolving market practices and the best interests of our Company and shareholders. Some of our key corporate governance policies and practices include:

|

| ||||||||||||||||||||||||

RIGHTS | •Annual election of directors • Shareholder right to call special meetings at 25% threshold • Proxy access with market standard terms • One-year limit on “poison pills” unless approved by shareholders • Single class of stock with equal voting rights • Majority vote standard and director resignation policy in uncontested elections | ||||||||||||||||||||||||

PRACTICES | •All directors are independent other than our Chief Executive Officer |

| • Independent Lead Director with clearly defined responsibilites • Commitment to Board refreshment practices, including committee chair rotation • Self-evaluation of all directors using third-party facilitator •Board oversight of political contributions | |||||||||||||||||||

|

|

| Regular executive sessions of independent directors for Board and committee meetings | |||||||||||||||||||

|

|

| Ongoing engagement with shareholders | |||||||||||||||||||

|

|

| Increased focus on ESG matters with | |||||||||||||||||||

|

|

| ||||||||||||||||||||

Our Board has also adopted Corporate Governance Principles that provide the framework for our existing corporate governance policies and practices. These Corporate Governance Principles address in detail matters such as director independence, director qualifications and responsibilities, director compensation, and director and officer stock ownership and retention. For more information, please see our Corporate Governance Principles under the “Governance” heading in the “Investors”Investors section on our website at www.tenethealth.com*.

Board Leadership Structure

The Company’s Board is led by an independent Chairman. As announced last year, Mr. Rittenmeyer, who had servedperiodically evaluates our leadership structure based upon our best interests and particular circumstances at the time. In August 2023, the Board decided to combine the roles of Chairman and Chief Executive Officer and appoint Dr. Sutaria, our Chief Executive Officer, to the role of Chairman, as the Executive Chairman, resigned in October 2022 due to personal health reasons, andwell. Also at that time, the Board appointed Senator Kerrey as Chairman. Lead Director, a role he held previously from October 2017 to October 2022.

The Board thoroughly considered a range of factors, including, among others, our strategic priorities and the complexity our business, Dr. Sutaria’s knowledge of the industry, the various capabilities of our directors, the highly independent composition of the Board, the meaningful responsibilities of the independent Lead Director, and the current environment of our industry. The Board has a high level of confidence in Dr. Sutaria’s leadership and ability to work closely and transparently with our independent directors. Moreover, the Board believes that, itin the role of Chairman and Chief Executive Officer, Dr. Sutaria is inbest positioned to be aware of key issues facing the Company and to serve as a highly effective bridge between the Board and management. The Board concluded that combining the Chairman and Chief Executive Officer roles, together with the strong independent leadership provided by our Lead Director role, serves the best interests of the Company and our shareholders for Senator Kerrey, who served as our Lead Independent Director since October 2017, to now serve as Chairman of the Board. Senator Kerrey possesses significant knowledge of our industry and a deep understanding of the Company’s strategic objectives, all of which will continue to benefit the Company during the year ahead.stockholders at this time.

The Company’s governing documents provide the Board the flexibility to determine the appropriate leadership structure for the Company based on our particular circumstances at a given time. The Governance Committee regularly reviews the Board’s leadership structure to assess the most effective structure based on applicable facts and circumstances at the time. This flexibility ensures the Board is best able to provide appropriate oversight of the Company, as well as address any circumstances the Company may face, as no single leadership model is universally or permanently appropriate in all circumstances. The Board believes that this flexibility has served the Company and its shareholders well during the transformation of the business.

2024 PROXY STATEMENT | 23 |

Corporate Governance and Board Practices

Role of Chairman of the BoardLead Director

The role of our ChairmanLead Director is set forth in our Corporate Governance Principles. Senator Kerrey, as independent ChairmanLead Director of the Board, coordinates the activities of the Board and exercises the robust set of duties described below. Specifically, in his role as independent Chairman,Lead Director, Senator Kerrey:

| • | Presides at all meetings at which the Chairman is not present |

| • | Chairs executive sessions of independent directors of the Board |

| • | Serves as the liaison between the Chairman and independent directors |

| • | Reviews and approves information sent to the Board |

| • | Reviews and approves Board meeting agendas and schedules |

| • | Calls meetings of independent directors as necessary |

| • | Participates in consultation and direct communication with shareholders |

| • | Advocates on behalf of the Board in meetings with investors, legislators, regulators and other government officials |

| • | Serves an oversight role, in conjunction with the Governance Committee, in the Board performance evaluation process |

Senator Kerrey has participated in in-person engagement meetings with a number of our significant shareholders to discuss and seek feedback on various matters regarding the Company’s strategy and governance practices, establishing a direct line of communication between shareholders and independent members of our Board. Senator Kerrey shares the feedback with the full Board so that it may be incorporated into the Board’s decision-making processes.

Board and Committee Organization and Responsibilities

Board Meetings and Attendance

We are governed by our Board. Members of our Board are kept informed of our business through discussions with our Chief Executive Officer and other senior officers, by reviewing materials provided to them, and by participating in meetings of the Board and its committees. Directors are also encouraged to attend continuing education courses relevant to their service on the Company’s Board. Significant business decisions are generally considered by the Board as a whole. The Board met ninesix times during 2022.2023. The independent directors of the Board, the Board and each committee of the Board frequently meet in executive sessions, including at least once during each regularly scheduled Board meeting.

Each incumbent director who served during 20222023 participated in at least 75% of the aggregate meetings of the Board and the committees on which he or she served during the period he or she served as a director and committee member. Board members are encouraged to attend our annual meeting of shareholders. All 10 directors elected at last year’s annual meeting were in attendance at the 20222023 Annual Meeting.

|

Corporate Governance and Board Practices

|

Committees

Tenet’s Board has four standing committees: Audit Committee, HR Committee, Governance Committee and QCE Committee. The Board also has one special committee: ESG Committee. The following table identifies the current members of each of our committees.

Director | Audit* | Human Resources | Governance | QCE | ESG | ||||||||||

Vineeta Agarwala, M.D., PhD |

|

| |||||||||||||

James L. Bierman |

| Chair | |||||||||||||

Roy Blunt |

|

|

| ||||||||||||

Richard W. Fisher |

|

|

| Chair | |||||||||||

Meghan M. FitzGerald | Chair |

|

| ||||||||||||

Cecil D. Haney |

|

|

| ||||||||||||

J. Robert Kerrey | Chair |

| |||||||||||||

Christopher S. Lynch |

|

|

| ||||||||||||

Richard J. Mark |

|

|

| ||||||||||||

Tammy Romo | Chair |

|

| ||||||||||||

Stephen H. Rusckowski |

|

|

| ||||||||||||

| |||||||||||||||

|

|

|

| ||||||||||||

Nadja Y. West, M.D. |

|

|

|

| |||||||||||

| * | All members of the Audit Committee have been designated as financially literate within the meaning of the NYSE listing standards. Mr. Fisher, Mr. Lynch and Ms. Romo have been designated as audit committee financial experts, as defined by SEC rules. |

Each of the Board’s standing committees operates under a written charter that is reviewed and approved annually by the respective committee. The charters are available for viewing under the “Governance” heading in the “Investors”Investors section on our website at www.tenethealth.com*. The Board and each committee may retain independent advisors and consultants, at the Company’s cost, to assist the directors in carrying out their responsibilities.

2024 PROXY STATEMENT | 25 |

Corporate Governance and Board Practices

The Audit Committee |

Meetings held in | 8

| |||||||||

| |||||||||||

Membership: Romo (Chair), Blunt, Fisher, Haney, Lynch, Mark (All Independent)

| |||||||||||

Primary Responsibilities: • Assist the Board in oversight of: • accounting, reporting and financial practices • the integrity of financial statements • compliance with legal and regulatory requirements with respect to applicable accounting and auditing matters • independent registered public accountant’s qualifications, independence and performance • internal audit function • cybersecurity • Establish and maintain policies and procedures for the receipt, retention and treatment of complaints and concerns regarding accounting, internal accounting controls and auditing matters • Authority to select, retain and review the independent registered public accountant’s qualifications, independence and performance • Oversee the performance of the Company’s chief internal auditor, who reports directly to the Audit Committee | Key Skills and Experience: • Expertise in auditing, accounting and tax-related matters • Preparation or oversight of financial statements • Extensive knowledge of compliance and relevant regulatory issues | ||||||||||

| |||||||||||

The ESG Committee |

Meetings held in | 2